Camelot Genesis Pools Launch

Genesis farms for a new DEX on Arbitrum.

DETAILS

- Launch Details

- Deposit in available genesis pools to earn native xGRAIL rewards and also additional partner token rewards in available partner pools

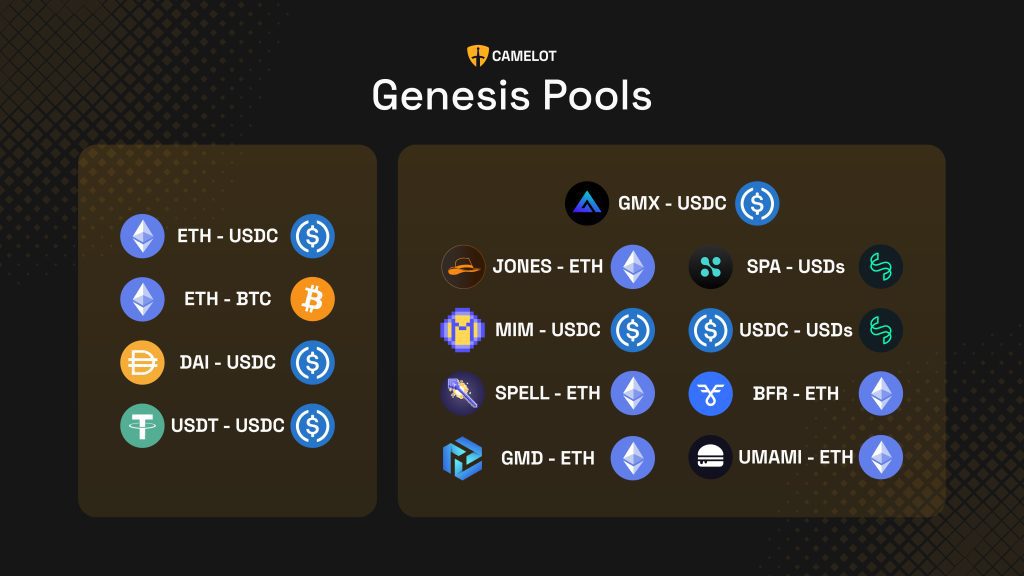

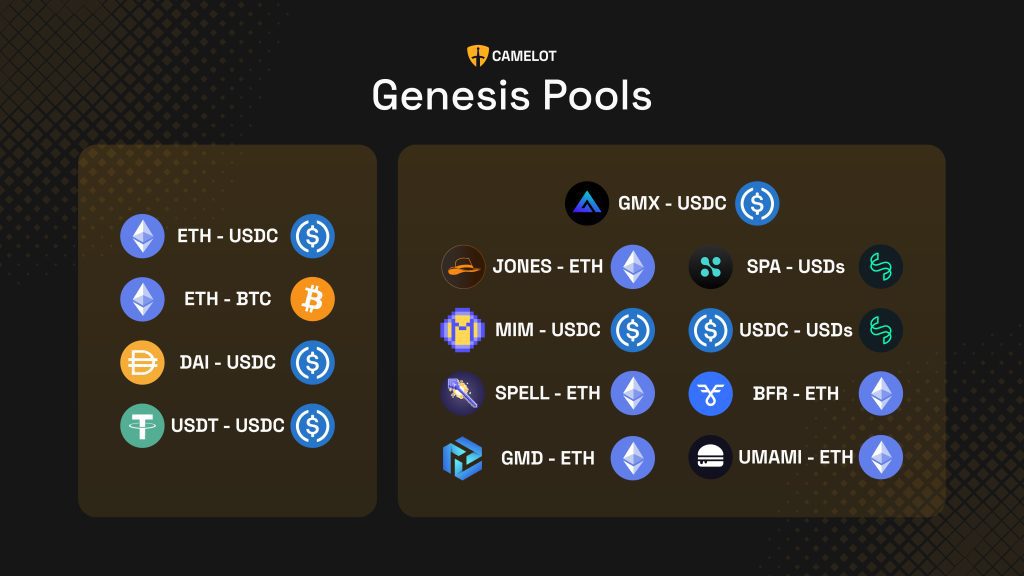

- Available genesis pools will include native & partner pools;

- Native pools – USDC/USDT, DAI/USDC, ETH/USDC, ETH/BTC

- Partner pools – GMX/USDC, MIM/USDC, SPELL/ETH, GMD/ETH, SPA/USDs, USDC/USDs, BRF/ETH, UMAMI/ETH, JONES/ETH

- Deposits will remain open until Dec 2 — after which, deposits are no longer possible

- Rewards emission will begin on Nov 23 (but can’t be harvested yet) and linearly distributed for 6 months

- Rewards harvesting will begin on Dec 7

- Normal LP farms open on Dec 6 and LP farming rewards begin on Dec 7. Genesis stakers will earn dual genesis and LP farming rewards

- To participate in the genesis farms;

- Create a position (spNFT) by adding liquidity for the available liquidity pairs

- spNFT will receive xGRAIL rewards automatically

- No deposit or withdrawal fee

- Deposits can be withdrawn anytime

- Mechanics & Features

- Camelot is a DEX based on a dual AMM able to support both volatile (UniV2) and stable (Curve) swaps

- Dual token system – native liquid GRAIL and escrowed version xGRAIL; a non-transferable governance token, both being used as farming rewards

- Features include;

- Dynamic directional swap fees – ability to set different fees depending on the direction of the swap

- swap referrals – partner projects can add its referral address and receive a part of their pool’s swap fees

- NFT staked positions (spNFT) – yield-bearing NFTs which can be staked in yield farms to earn GRAIL, or in fixed-duration Nitro pools to earn xGRAIL

- Dividends & yield booster – stake xGRAIL and earn a share of protocol earnings; 0.5% unstake fee

- governance – xGRAIL is the governance token, more xGRAIL held, more voting power

- Protocol earning (fees) distributed as;

- 60% for Liquidity Providers in LP tokens

- 22.5% in dividends redistributed to xGRAIL holders

- 12.5% for GRAIL buyback and burn

- 5% to the Core Contributors funds

- Tokenomics

- Token symbol: GRAIL

- Token supply: 100,000

- 15% — Public sale (5% xGRAIL & 10% GRAIL)

- 10% — Protocol Owned Liquidity (7.5% used for initial liquidity, pre-minted in a multisig)

- 5% — Genesis Nitro Pools (distributed as xGRAIL – 6 months linearly vesting)

- 22.5% — Liquidity Mining (3 years linear vesting)

- 20% — Core Contributors (3 years linear vesting)

- 10% — Partnerships (6 months cliff, then 2 years vesting)

- 8% — Reserves (pre-minted in a multisig)

- 5% — Ecosystem

- 2.5% — Development Fund (3 years linear vesting)

- 2% — Advisors (3 years linear vesting)